服務(wù)産(chǎn)品

高品質(zhì)服務(wù),省心又(yòu)省錢,全程一站式服務(wù)

我們的優勢

高品質(zhì)服務(wù),省心又(yòu)省錢,全程一站式服務(wù)

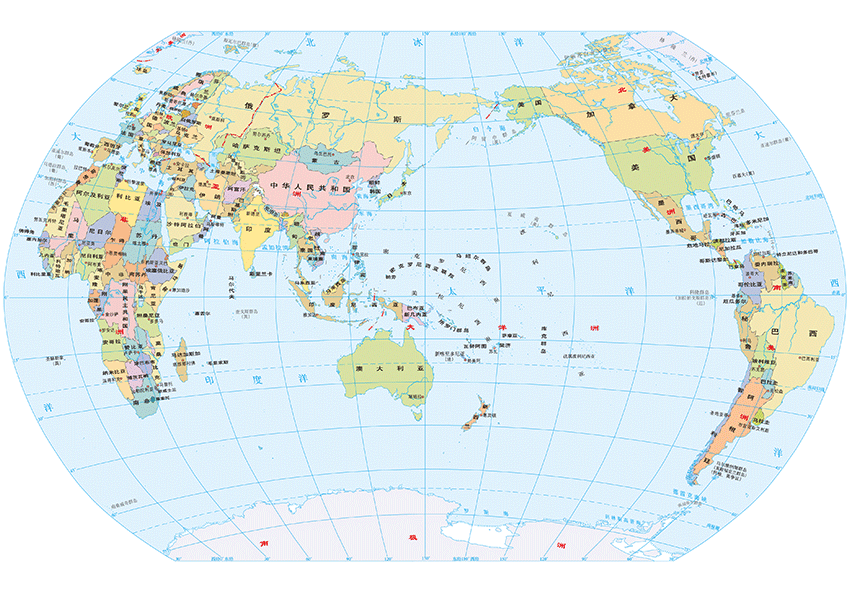

全球承運,方案多(duō)樣

覆蓋全球100多(duō)個國(guó)家和地區(qū)。國(guó)家和地區(qū)。國(guó)家和地區(qū)。

艙位保障,優先發貨

信用(yòng)保障訂單享受旺季艙位保障,優先發貨,買家不用(yòng)等。

費用(yòng)透明,直達低價

費用(yòng)透明,直達低價費用(yòng)透明,直達低價費用(yòng)透明,直達低價

贈送保險,理(lǐ)賠快速

贈送保險,理(lǐ)賠快速贈送保險,理(lǐ)賠快速

成功案例

高品質(zhì)服務(wù),省心又(yòu)省錢,全程一站式服務(wù)

服務(wù)區(qū)域

高品質(zhì)服務(wù),省心又(yòu)省錢,全程一站式服務(wù)

全球1萬+客戶覆蓋約500個城市

進口、出口、空運、海運、陸運、清關、倉儲一體(tǐ)化解決方案服務(wù)商(shāng)

1萬+客戶

700+城市

7X12h一對一管家式服務(wù)

服務(wù)指南

高品質(zhì)服務(wù),省心又(yòu)省錢,全程一站式服務(wù)

公(gōng)司動态

為(wèi)您展示大順公(gōng)司最新(xīn)新(xīn)聞事件

常見問題

你問我答(dá),讓我們的合作(zuò)沒有(yǒu)疑問

旗下公(gōng)司

平台豐富、功能(néng)健全, 隻為(wèi)全面服務(wù)好客戶業務(wù)

大順國(guó)際貨運代理(lǐ)(北京)有(yǒu)限公(gōng)司

大順供應鏈管理(lǐ)(北京)有(yǒu)限公(gōng)司

大順快運(北京)有(yǒu)限公(gōng)司

北京空港興順國(guó)際供應鏈管理(lǐ)有(yǒu)限公(gōng)司